It has been nearly two decades since the state of Illinois had a balanced budget.

Faced with a mounting debt crisis and growing social unrest, the state is grappling with the very real possibility of being downgraded to junk status. Yet, Illinois’ most recent budget deficit ran much smaller than many had expected, raising fresh suspicion over the state’s accounting practices.

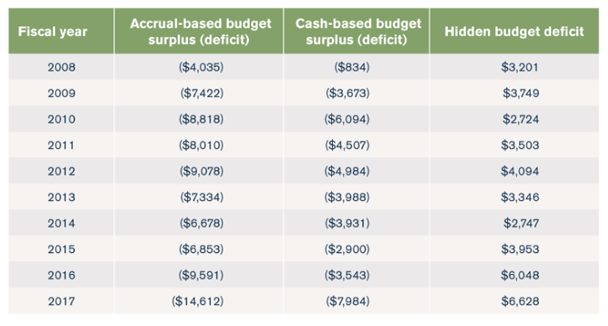

A study conducted by the Illinois Policy Institute found that state lawmakers employed “cash-based” accounting as a way to mask the true extent of the budget shortfall. The Policy Institute determined that the reported deficit of just under $8 billion for fiscal 2017 was really $14.6 billion when factoring in spending incurred in the actual year.

Against this backdrop, investors must be reminded that Illinois’ perilous financial situation cannot be concealed or distorted through unethical accounting practices. This is important to bear in mind when weighing the decision to invest in the state’s municipal bonds.

Be sure to use our Muni screener when looking for your next potential investment.

Illinois’ Financial Woes: A Brief Primer

Illinois finances have been in a state of disarray since at least 2001, with average budget deficits running in the billions. Although the Illinois Constitution requires local lawmakers to pass balanced budgets, they have failed to do since 2001. What’s more, Springfield has relied on “cash-based” budgeting throughout its deficit-running years even as state policy groups lobbied for an accrual-based accounting system.

At last check, the state government carried more than $200 billion in debt, a figure that is likely to grow as the pool of pensioners continually expands. State borrowing to cover pension obligations was the primary catalyst for the ballooning budget deficit following the 2008 financial crisis. A series of debacles between 2011 and 2015 resulted in incomplete budgets and unfunded spending that was later uncovered by the Illinois Policy Institute.

Efforts to conceal the extent of the budget damage partly explain the constant lag in releasing audited financial statements. In July 2017, the state passed its first budget in two years after lawmakers pushed through a deal that was opposed by several Republicans in the Democrat-controlled legislature. Much of the disagreement was over a proposed income tax hike.

Check out our article on Illinois’ similarities with the Puerto Rico debt crisis.

Accounting Practices

Under growing pressure to cut the budget deficit, state lawmakers have resorted to creative accounting and other manipulative practices to conceal the extent of the damage. By adopting a “cash-based” budgeting system, state lawmakers have been able to delay when certain spending appears on their record. Under such a system, expenses are only recorded when the cash is paid. This means that expenses, where payment is delayed until next fiscal year, are not included in this year’s expenses.

While this may appear slightly better on paper, Illinois is incurring more interest liabilities by delaying the payment of expenses until next fiscal year. This only perpetuates the cycle of burgeoning budget deficits in future years.

Though efforts are underway to cut Illinois’ massive deficit, many believe this won’t be enough to balance the books. It’s also apparent that the state’s shady accounting practices will inflate the actual impact of the proposed measures. Despite a record $5 billion permanent income tax increase, the fiscal 2018 budget is projected to be out of balance to the tune of billions of dollars. However, using the cash-based formula, the deficit would only appear as $590 million.

Be sure to check out this article to remain aware of the due diligence process for evaluating municipal bonds.

The chart below highlights the extent to which cash-based accounting distorts the facts with respect to Illinois’ budget deficit.

By providing non-GAAP numbers, Illinois can continue raising money at cheaper rates than it otherwise would have had it used GAAP accrual accounting. This means investors are likely overpaying for Illinois debt given the actual levels of risk involved.

Check out the different ways to invest in muni bonds to stay up to date with the current investment strategies.

The Bottom Line

Whether you’re evaluating public debt or any other financial asset, a cursory glance at Comprehensive Annual Financial Reports (CAFRs) isn’t enough to paint an accurate picture. Rather, investors must evaluate how various numbers are calculated, as well as the implications those calculations have on the long-term sustainability of an investment.