For many investors, the municipal bond sector is about one thing: high after-tax income potential. Thanks to Uncle Sam, interest on muni bonds is free from federal taxes. And in many cases, it’s free from state and local taxes as well. Because of this fact, munis tend to have very high after-tax yields when compared to other bond varieties. Many investors across the income spectrum have turned to munis for this reason.

But those high yields aren’t the only reason to be loving the municipal bond sector.

It turns out municipal bonds can offer portfolios plenty of benefits besides that high yield and tax-free income. From stability to inflation fighting, munis are much more than just their yields.

Tax-Free Income

Municipal bonds are issued by state and local governments to fund their operations, launch special projects, and provide citizens with various programs. To help state and local governments enjoy a lower cost of capital for their funding and borrowing needs, Uncle Sam has cut them a break since 1913. Municipal bondholders have enjoyed interest-free federal income taxes. Many states enable muni bond holders to save on state and local taxes as well.

As a result, this exemption on interest has long been a key feature of municipal bonds, and they have long been a portfolio holding for many high-net-worth family, insurance, and institutional portfolios.

The effect is that municipal bonds have very high taxable equivalent yields (TEYs).

A TEY is essentially a return calculation that puts a taxable bond and tax-exempt muni on equal footing. It’s what you would have to earn on a taxable bond such as an investment-grade corporate or mortgage-backed security to make the same after-tax rate on a muni.

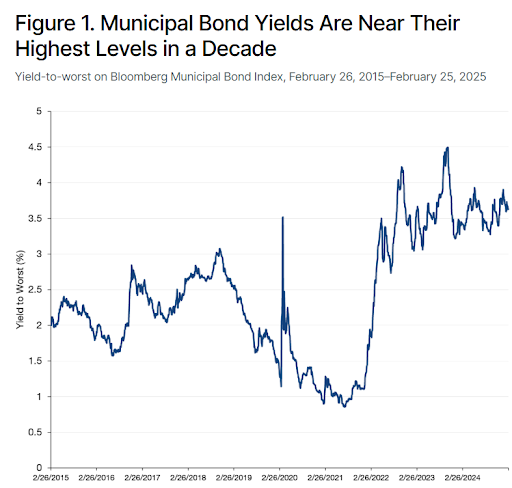

And right now, municipal bonds are yielding some of their highest amounts in over a decade. This chart from asset manager Lord Abbett shows the high yields available in munis.

Source: Lord Abbett

Moving Beyond the High Yield

The issue is that TEY becomes less advantageous as you move down the tax-bracket ladder. A 3.49% yield is worth a 5.90% TEY for someone in the highest tax bracket. However, it’s only worth about 3.88% for some in the lowest. Someone in a lower bracket might still make out on yield looking toward other bond varieties. As such, they often skip municipal bonds for their portfolios.

That’s a real shame as munis offer a host of benefits besides their tax-free nature.

For one thing, they are incredibly safe when it comes to defaults. Thanks to the ability of a state to raise taxes to pay off its debts, munis have continued to enjoy high credit quality. Most municipal bonds carry investment-grade ratings. Additionally, default rates for munis are lower than comparable corporate bonds.

According to Lord Abbett, data shows the average 10-year cumulative default rates from 1970 to 2022 for investment-grade municipal bonds was just 0.09%. This compares to 2.23% for IG corporate bonds. Looking at the high-yield market, muni defaults for the period were just 6.84%. This compares to 29.81% for junk bonds.

This lower default rate can provide a layer of true safety for a fixed income portfolio and reduce volatility. Munis have historically been less volatile than other bond varieties and even less so than Treasuries with the recent market hiccups. This makes them a true ballast for a fixed income portfolio and equities.

Another reason to consider munis beyond their tax-free yields could be their ability to fight inflation.

General obligation (GO) bonds—which are funded by taxes and are what we think of when we think of municipal bonds—only make up about 30% of the market. The rest are revenue-backed bonds. These are bonds issued to fund projects like tolls, public utilities, education, and mass transit. Their payment ability is driven by the revenues collected for their use. And often, fees collected are tied to measures of inflation. The end result is that munis often see price increases during periods of rising CPI, making them a secret weapon to fight inflation.

Then there are the tariffs to consider. Unlike many corporate bond issuers, muni bonds are 100% domestically focused. Given all the uncertainty surrounding global trade, foreign/international revenues, and other geopolitical risks, munis are one of the few America First asset classes. As such, they could be a real port in the storm as the trade issues pan out.

Taking a Serious Look at Munis Beyond the Yields

For many investors, munis are all about the tax-free high yield. But the reality is, as an asset class, they can offer benefits for anyone, not just the super rich or those in high tax brackets. Their low default rates and strong credit quality offer a potential to add some stability to a portfolio, while their inflation-fighting ability is a hidden win for the asset class.

Adding in the sector’s huge diversity—with muni bonds covering states, towns, universities, hospitals, toll-roads, charter schools, and even public utilities—you have a real recipe for success outside their yields.

To that end, munis make a ton of sense for every investor, no matter their tax bracket. Adding them is easy, when it comes to funds. Individual munis still remain hard to purchase for many regular retail investors. But there are numerous ETFs and other funds that cover the market. Additionally, active management can play a big role in the sector.

Municipal Bond ETFs

These ETFs were selected based on their exposure to municipal bonds at a low cost. They are sorted by their YTD total return, which ranges from -1.7% to 1%. They have expense ratios between 0.03% and 0.65% and assets under management between $1.5B and $41B. They are yielding between 2.3% and 3.4%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SUB | iShares Short-Term National Muni Bond ETF | $9B | 1% | 2.3% | 0.07% | ETF | No |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.5B | 1% | 2.6% | 0.20% | ETF | No |

| DFNM | Dimensional National Municipal Bond ETF | $1.5B | -0.1% | 3.1% | 0.18% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.8B | -0.2% | 3.3% | 0.35% | ETF | Yes |

| FMB | First Trust Managed Municipal ETF | $2.1B | -1.6% | 3.4% | 0.65% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $41B | -1.6% | 3.3% | 0.05% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $39.5B | -1.7% | 3.4% | 0.03% | ETF | No |

All in all, municipal bonds are often praised for their high after-tax yields, and rightfully so. Their after-tax yields can be a serious income boost for many investors. The shame is other investors ignore their other potential benefits. It’s those benefits that make muni bonds a big buy for everything.

The Bottom Line

Municipal bonds and tax-free yields go hand in hand. But they can offer other wins as well. Inflation fighting and portfolio stability are just some of the reasons why all investors should consider the asset class.